EMI Calculator – Definition, Benefits & How to Use

[emi_calculator]

What is an EMI Calculator?

An EMI (Equated Monthly Installment) Calculator is an online financial tool that helps borrowers estimate the fixed monthly payment they must make over the tenure of a loan. It considers three key factors:

- Loan Amount (Principal)

- Interest Rate

- Loan Tenure (in months or years)

When you take out a loan—whether it’s for a house, car, or education—an EMI calculator turns large loan figures into simple, predictable monthly payments. It’s an easy way to plan budgets, compare offers, and understand repayment timelines.

How It Works

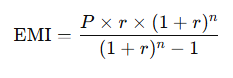

The EMI formula used worldwide is:

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate ÷ 12)

- n = Number of monthly payments

This ensures you pay off both principal and interest in full by the end of the tenure, with equal monthly installments.

Applications of an EMI Calculator

1. Home Loans

When purchasing property in Pakistan, the U.S., or China, a home loan calculator helps you understand how much you’ll pay every month based on interest rates and loan tenure. It’s vital for managing mortgage affordability and comparing offers from multiple banks (e.g., Bank of China, HBL, or Wells Fargo).

2. Auto Loans

Planning to buy a car? An EMI calculator shows you the impact of choosing a 3-year vs. 5-year loan term. You can find out which EMI fits best in your monthly income before committing.

3. Personal or Education Loans

Whether you’re financing higher education in the U.S. or a small business in Pakistan, an EMI calculator helps assess affordability and repayment flexibility. You can test how different rates or tenures change your total interest cost.

4. Loan Comparison & Planning

Want to see the difference between two offers — say, one from a U.S. lender and one from a Pakistani bank? Just adjust the values in the calculator to visualize which one saves you more.

Benefits of Using an EMI Calculator

✅ Accurate & Instant Results

Forget manual formulas or spreadsheets. With a single click, you get your exact EMI amount instantly — saving time and preventing errors.

✅ Better Budget Planning

By knowing your monthly outflow, you can ensure your repayments stay within your budget. For example, many experts in the U.S. recommend keeping your EMI under 40% of your monthly income.

✅ Cost Transparency

An EMI calculator helps you see the total interest payable over the loan period — so you know exactly how much you’re paying the lender in total.

✅ Scenario Testing & Comparison

You can easily tweak values (loan amount, tenure, rate) to test multiple “what if” situations — ideal for comparing offers from banks in different countries.

✅ Time-Saving & Reliable

No risk of calculation mistakes. It’s instant, accurate, and available 24/7 on your device.

Why Every Borrower Needs an EMI Calculator

Modern financial systems in Pakistan, China, and the U.S. all rely on consumer borrowing — for homes, vehicles, and personal needs.

Using an EMI calculator helps you:

- Stay in control of your monthly budget

- Compare international loan offers efficiently

- Avoid over-borrowing by testing repayment scenarios

- Plan better for future savings and investments

How to Use an EMI Calculator (Step-by-Step)

- Enter the Loan Amount you plan to borrow.

- Enter the Annual Interest Rate offered by your lender.

- Enter the Tenure (in months or years).

- Click “Calculate”.

- Review the Monthly EMI, Total Interest, and Total Payment results.

- Adjust values to see how your monthly cost changes with different rates or durations.

This lets you make informed choices before even applying for a loan.

Common Misconceptions & Tips

- A lower EMI isn’t always better — longer tenures can mean you pay more total interest.

- Always check whether your loan has a fixed or variable interest rate.

- Remember to factor in processing fees, insurance, or early payment penalties.

- Aim for your total EMI payments to stay under 30–40% of your net income.

Final Thoughts

An EMI calculator is one of the most practical online tools for financial decision-making — whether you’re taking a mortgage in the U.S., a personal loan in Pakistan, or a vehicle loan in China.

It offers clarity, transparency, and peace of mind — empowering you to choose the best loan terms that suit your budget and goals.

Integrating an EMI calculator directly into your website not only adds value for users but also improves your SEO ranking, engagement time, and conversion rate — especially when you target finance-related keywords in your content strategy.